Introduction

Discover the psychology of the wealthy and learn how rich people think, build habits, and create lasting financial success with proven strategies.

Have you ever wondered why some individuals build massive fortunes while others struggle paycheck to paycheck—even when they have similar opportunities? The answer often lies in mindset. Money follows psychology, not just effort. The psychology of the wealthy is about how rich people think, perceive opportunities, manage risks, and shape their habits.

It’s not always about starting with privilege or luck. In fact, many self-made millionaires and billionaires were once ordinary people who transformed their lives through mindset shifts. By understanding how wealthy individuals think, you can start reprogramming your own financial behavior and create a roadmap toward success.

This blog explores the key principles of the wealthy mindset, the habits that shape their psychology, and practical steps you can apply to your own life.

1. The Core Mindset of Wealthy Individuals

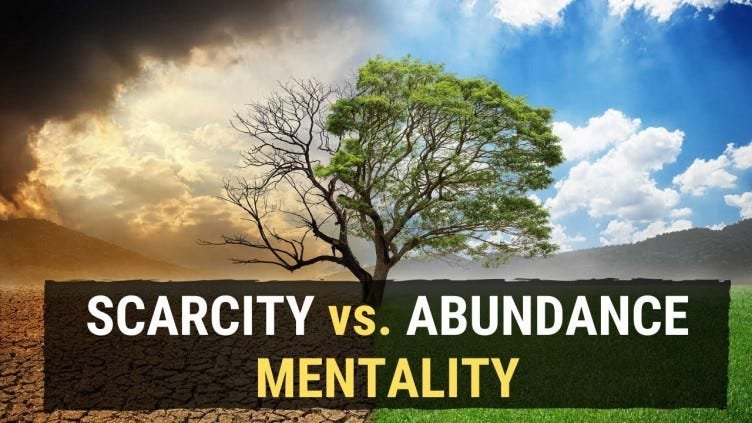

1.1 Abundance vs. Scarcity Thinking

The biggest difference between the wealthy and average individuals is how they view resources.

- Scarcity mindset: Believes opportunities are limited. People in this mindset think, “If someone else wins, I lose.” They play safe, avoid risks, and often feel stuck.

- Abundance mindset: Wealthy people believe opportunities are endless. They think, “There’s enough success for everyone.” This psychology encourages them to innovate, invest, and take bold action.

For example, Warren Buffett didn’t become one of the richest men in the world by fearing losses—he embraced opportunities that others were too scared to touch.

1.2 Long-Term Vision Over Short-Term Gains

The wealthy think in decades, not days. They prioritize sustainable wealth instead of chasing instant gratification. While many chase trends for quick profits, the wealthy invest in assets, businesses, and skills that grow over time.

Jeff Bezos once said, “If everything you do needs to work in three years, you’re competing against a lot of people. But if you’re willing to invest for seven years, you’re now competing against a fraction.” That’s the psychology of long-term wealth creation.

2. Habits That Shape the Wealthy Mindset

2.1 Continuous Learning & Growth

One of the most underrated traits of wealthy individuals is their commitment to lifelong learning.

- Bill Gates reads 50+ books every year.

- Elon Musk taught himself rocket science by reading and networking with experts.

- Oprah Winfrey attributes much of her success to constant self-education.

Wealthy individuals treat learning as an investment, not an expense. They invest in mentors, courses, and personal growth—knowing that knowledge compounds just like money.

2.2 Calculated Risk-Taking

Unlike common belief, wealthy people are not reckless gamblers. Their psychology revolves around calculated risk-taking. They analyze, prepare, and act when the odds are in their favor.

For instance, Richard Branson launched Virgin Airlines when many thought it was too risky. But instead of diving blindly, he negotiated a risk-free lease for his first aircraft—minimizing downside while maximizing upside.

2.3 Resilience & Adaptability

Failures are not roadblocks but stepping stones for the wealthy.

- Steve Jobs was fired from Apple, the company he founded, but returned years later to make it one of the world’s most valuable companies.

- Henry Ford went bankrupt multiple times before revolutionizing the automobile industry.

3. The Role of Psychology in Wealth Creation

3.1 Emotional Intelligence & Money

The wealthy don’t just manage money; they manage emotions around money. Fear, greed, and impatience are the enemies of wealth. High emotional intelligence allows them to stay calm during downturns and make rational decisions.

For example, during market crashes, average investors panic and sell. Wealthy investors often buy, because they see opportunities where others see fear.

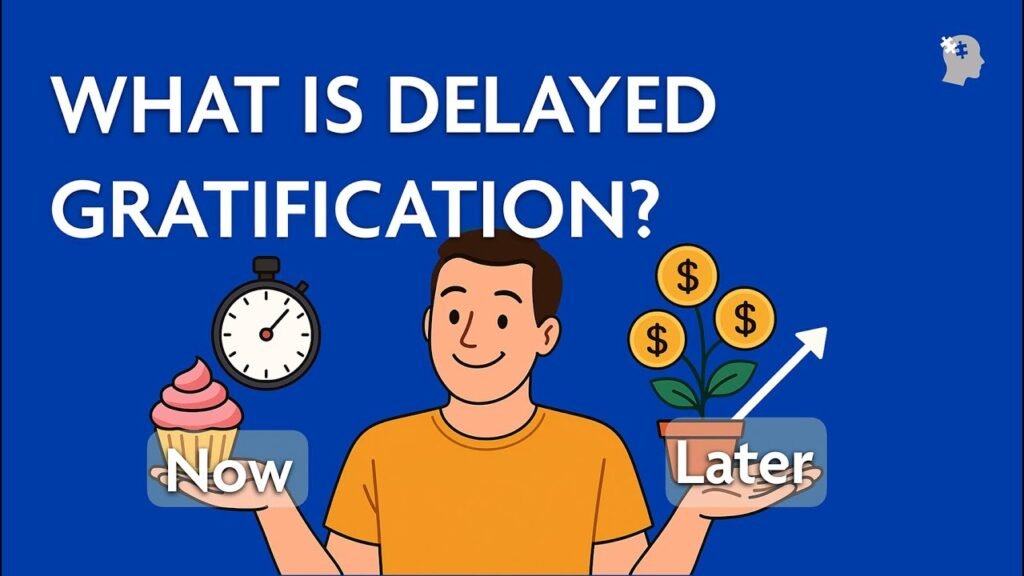

3.2 Delayed Gratification

Wealthy people understand the power of delayed gratification. Instead of spending money on instant pleasures, they reinvest earnings into things that create more wealth.

Consider this: if you spend $1,000 on a luxury item today, it loses value. But if you invest that $1,000 in an asset that grows at 10% annually, it becomes over $2,500 in 10 years. The wealthy choose the second option.

3.3 Networking and Social Influence

Another key part of wealthy psychology is understanding the value of networks. Wealthy people build powerful circles. They surround themselves with ambitious, successful, and like-minded individuals.

Jim Rohn famously said, “You are the average of the five people you spend the most time with.” Wealthy individuals carefully curate those five people.

4. Stories That Reflect the Psychology of the Wealthy

Elon Musk – Thinking Beyond Limits

Elon Musk is a powerful example of how the psychology of the wealthy thrives on bold vision. While most people focus on small wins, Musk imagines transforming humanity—whether it’s colonizing Mars or revolutionizing transport with Tesla. SpaceX almost went bankrupt after three failed rocket launches, but instead of quitting, he invested his last remaining capital to fund a fourth launch. That mission succeeded, and today SpaceX is valued at billions. Musk proves that wealthy minds combine resilience, risk-taking, and unshakable belief in possibility.

Sara Blakely – Turning Rejection Into Success

Sara Blakely, the self-made billionaire behind Spanx, turned constant rejection into fuel for growth. With only $5,000 in savings, she faced manufacturers who dismissed her idea of footless pantyhose. Instead of giving up, she reframed rejection as guidance and improved her product pitch. Eventually, one factory owner gave her a chance. Today, Spanx is a global fashion empire. Blakely’s story shows how persistence, optimism, and creative problem-solving define the mindset of the wealthy.

Warren Buffett – The Power of Patience

Warren Buffett’s story highlights the role of discipline and delayed gratification in wealth psychology. Known as the “Oracle of Omaha,” Buffett buys undervalued companies and holds them for decades, ignoring market hype. His Coca-Cola investment, made in the late 1980s, continues to generate billions in dividends. While others panic during downturns, Buffett remains calm and even buys more. His patience demonstrates that long-term thinking is one of the most valuable traits of the wealthy.

5. How You Can Apply the Wealthy Mindset

The good news? You don’t need to be a billionaire to adopt the psychology of the wealthy. You can start building this mindset today with small, intentional shifts.

- Shift to Abundance Thinking – Instead of saying “I can’t afford this,” ask “How can I afford this?” This simple reframe opens your brain to problem-solving.

- Invest Early & Consistently – Even ₹500 or $10 a week invested compounds over time. The earlier you begin, the more your money works for you.

- Reframe Failure – Failure is feedback. Keep a journal of setbacks, noting what each one taught you. Over time, you’ll see failure as a stepping stone.

- Emotional Discipline – The wealthy make decisions based on logic, not fear or hype. Create clear rules for spending, saving, and investing—and stick to them.

- Continuous Learning – Wealthy people read daily, listen to podcasts, and seek mentors. Knowledge compounds like money, giving you an edge in decision-making.

- Surround Yourself With Winners – Your environment shapes your mindset. Networking with ambitious, positive people pushes you to think bigger and act smarter.

- Practice Gratitude – Many wealthy individuals keep gratitude journals. Gratitude reduces stress, improves clarity, and attracts more opportunities.

By integrating these practices, you reprogram your brain for success. Remember, the journey to wealth starts in the mind. The psychology of the wealthy is about habits, mindset, and resilience—money is simply the result of thinking differently.

Conclusion

The journey to financial success begins not with money, but with mindset. The psychology of the wealthy teaches us that abundance thinking, emotional discipline, and resilience in the face of failure are more valuable than any quick-win strategy. From Elon Musk’s bold risk-taking to Warren Buffett’s patient investing, the wealthiest individuals prove that fortune favors those who think differently.

You don’t need billions to start—you need clarity, consistency, and the belief that growth is possible. By shifting your mindset, practicing gratitude, surrounding yourself with positive influences, and embracing lifelong learning, you can rewire your approach to money and success.

Remember: wealth is built first in the mind, and then in the bank. Start applying the psychology of the wealthy today, and you’ll be taking the first step toward creating your own path to abundance.