In 2025, you can use AI-powered apps to automatically track your spending, build an emergency fund, and start investing with as little as ₹500 through regulated platforms offering index funds, ETFs, and AI-driven portfolios. These tools analyze your income, UPI transactions and goals in real time to create a personalized money plan while you stay in control.

Table of Contents

ToggleWhy This Matters in 2025 (Especially If You’re Gen Z or a Young Professional)

If you’re swiping UPI 20 times a week, juggling subscriptions, and watching “finance reels” but still feel broke at month-end—you’re not alone.

- Gen Z is actively rewriting the rules of money with digital wallets, UPI, and app-based investing.

- Adoption of AI-powered investing tools has jumped sharply; over one-third of affluent investors now use them, with Gen Z and Millennials leading the way.

- The WealthTech market in India is projected to cross $60 billion by 2025, driven by platforms using AI for hyper-personalized advice.

- AI budgeting and finance tools are exploding in India — from budgeting apps to robo-advisors and AI-driven goal planners.

So the big question is no longer “Should I use AI for my money?”

It’s “How do I use AI smartly, safely, and profitably?”

That’s exactly what this guide will show you, step by step.

Quick Summary: How to Use AI for Your Money in 2025

If you just want the fast, answer-engine-style summary, here it is:

- Use an AI budgeting app to track all your spending (UPI, cards, cash) and set categories + limits.

- Automate savings: set up auto-transfers (even ₹50–₹100 per day) into a high-interest savings or liquid fund.

- Start investing with ₹500: use SEBI-regulated platforms to buy index funds/ETFs or start an AI-managed conservative portfolio.

- Let AI help with decisions, not control them: always double-check major moves and keep your goals + risk in mind.

- Review monthly in 20 minutes: use the app’s dashboards to see if your spending, saving, and investing are on track.

The sections below break each of these into practical, beginner-friendly steps.

1Step 1: Fix Your Cash Flow with AI Budgeting Apps

What Is an AI Budgeting App (in simple words)?

An AI budgeting app connects to your bank, UPI, and card accounts and then:

- Automatically categorizes your spending (e.g., food, travel, rent, shopping).

- Spots patterns and leaks (“You spent 32% more on food this month”).

- Predicts your cash flow and warns you before you overspend.

Think of it as a 24/7 money assistant that doesn’t judge you, just shows you reality.

How It Helps You Today

Most young Indians:

- Don’t know where their money is going.

- Feel “broke” before salary day.

- Underestimate how much small UPI spends add up.

AI fixes this by:

- Giving you a live view of how much is “safe to spend”.

- Sending smart alerts (“If you keep spending like this, you’ll be short ₹3,200 before month-end”).

- Suggesting category caps based on your income and goals.

Simple Setup (15 minutes)

- Pick an AI-enabled app (examples in India: budgeting + expense tracker apps listed by fintech blogs for 2025).

- Connect your accounts (UPI/bank/card) using secure, read-only access.

- Let it sync 2–3 months of history so the AI can learn your pattern.

-

Set custom categories + goals:

- Essentials: rent, food, transport

- Lifestyle: shopping, travel, subscriptions

- Goals: emergency fund, investments

2Step 2: Build an Emergency Fund Using Automation

Before you think about stocks, crypto, or options, you need one thing:

An emergency fund of 3–6 months of expenses.

How AI Makes This Easier

AI-powered finance tools can:

- Analyze your average monthly spend.

- Recommend a target emergency fund amount (e.g., ₹75,000).

- Suggest a realistic monthly savings plan (e.g., ₹5,000/month for 15 months).

Some apps even auto-sweep:

- Spare change from transactions.

- A fixed % of salary whenever it hits your bank.

Where to Park Your Emergency Fund (Low-Risk Options)

Note: Always check latest rates and SEBI/RBI guidelines and consult a registered advisor for personalized choices.

Common options explained in many Indian personal-finance guides for 2025 include:

- High-interest savings accounts – low risk, instant access.

- Liquid mutual funds – slightly better returns, usually 1–2 day withdrawal.

- Short-term debt funds – for slightly higher return with a bit more risk.

Your Action Plan

- Decide a target amount (e.g., 3 months of rent + food + essentials).

- Use an AI app or calculator to create a timeline.

- Automate a fixed transfer right after payday.

- Don’t invest this money in high-risk assets.

3Step 3: Start Investing with Just ₹500 Using AI & Low-Cost Platforms

This is the most exciting part.

Yes, you can start investing in 2025 in India with as little as ₹500.

Where Can You Invest Small Amounts?

Based on current 2025 trends:

-

Index Funds & ETFs

Track indices like Nifty 50 / Sensex.

Good for beginners; low cost and diversified. -

AI-Powered Robo-Advisors / Platforms

Use algorithms to build a portfolio based on your risk and goals.

Automatically rebalance, tax-optimize, and adjust based on markets. -

Thematic / Sector Funds (Use with caution)

Example: tech, renewable energy, pharma – high potential, higher risk.

How AI Helps You Invest Smarter (Not Just Faster)

AI tools today can:

- Suggest a portfolio mix (e.g., 70% index funds, 20% debt, 10% gold).

- Run risk simulations (“If markets fall 20%, your portfolio may drop 12%”).

- Alert you when you’re too concentrated in one sector or stock.

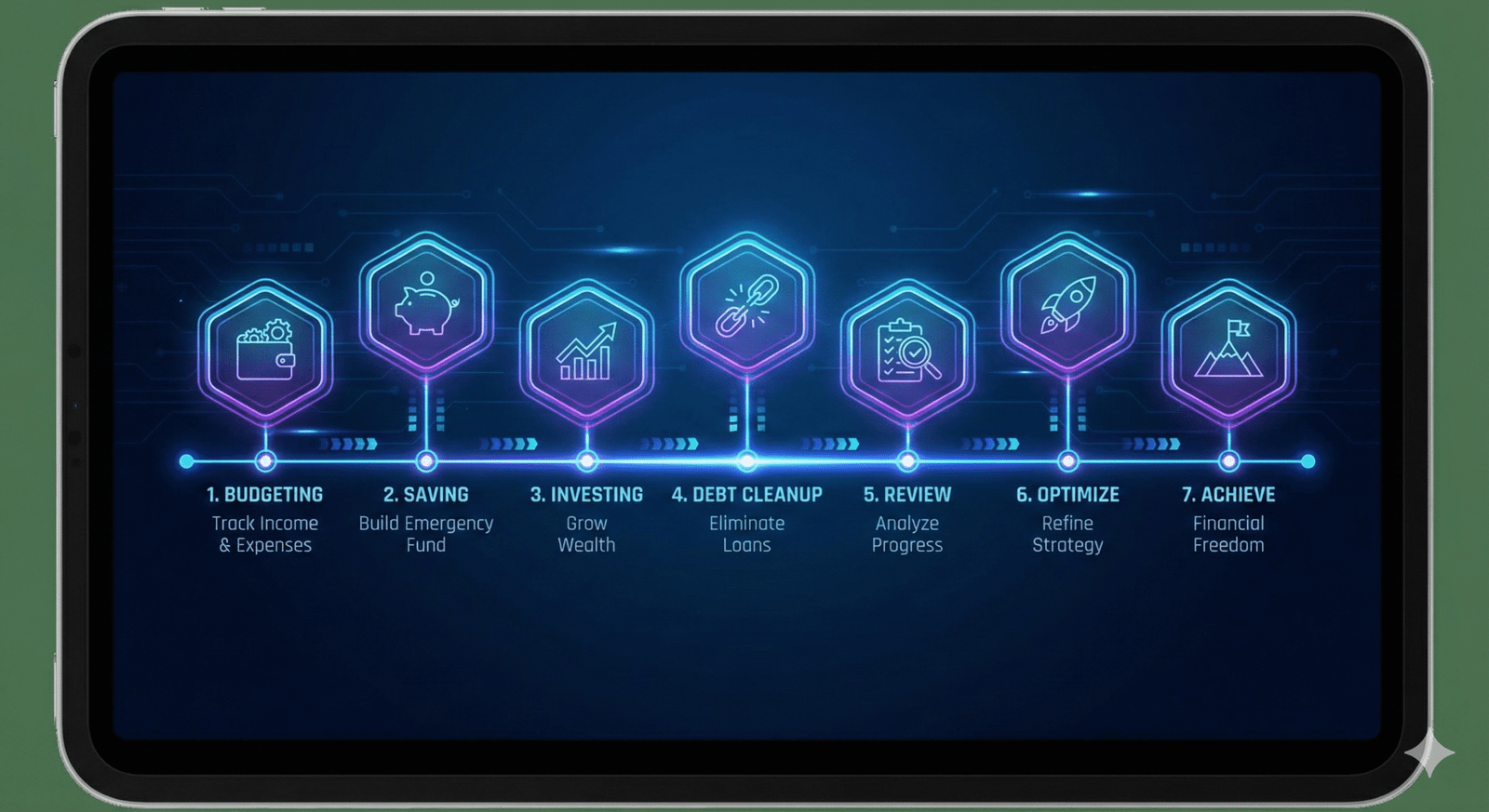

7-Step Beginner-Friendly AI Investing Flow (₹500+)

- Choose a SEBI-regulated platform (broker or robo-advisor).

- Complete KYC (PAN, Aadhaar, bank account).

- Answer risk and goal questions honestly (short-term vs long-term, risk comfort).

- Let the AI suggest a starter portfolio.

- Begin with ₹500–₹1,000 in a low-cost index fund or conservative AI portfolio.

- Set up auto-invest (SIP) – even ₹500/month builds discipline.

- Review quarterly; don’t panic over daily price moves.

Important: AI can enhance your decisions but cannot remove risk. Markets can go up or down. Only invest money you won’t need in the next 3–5 years.

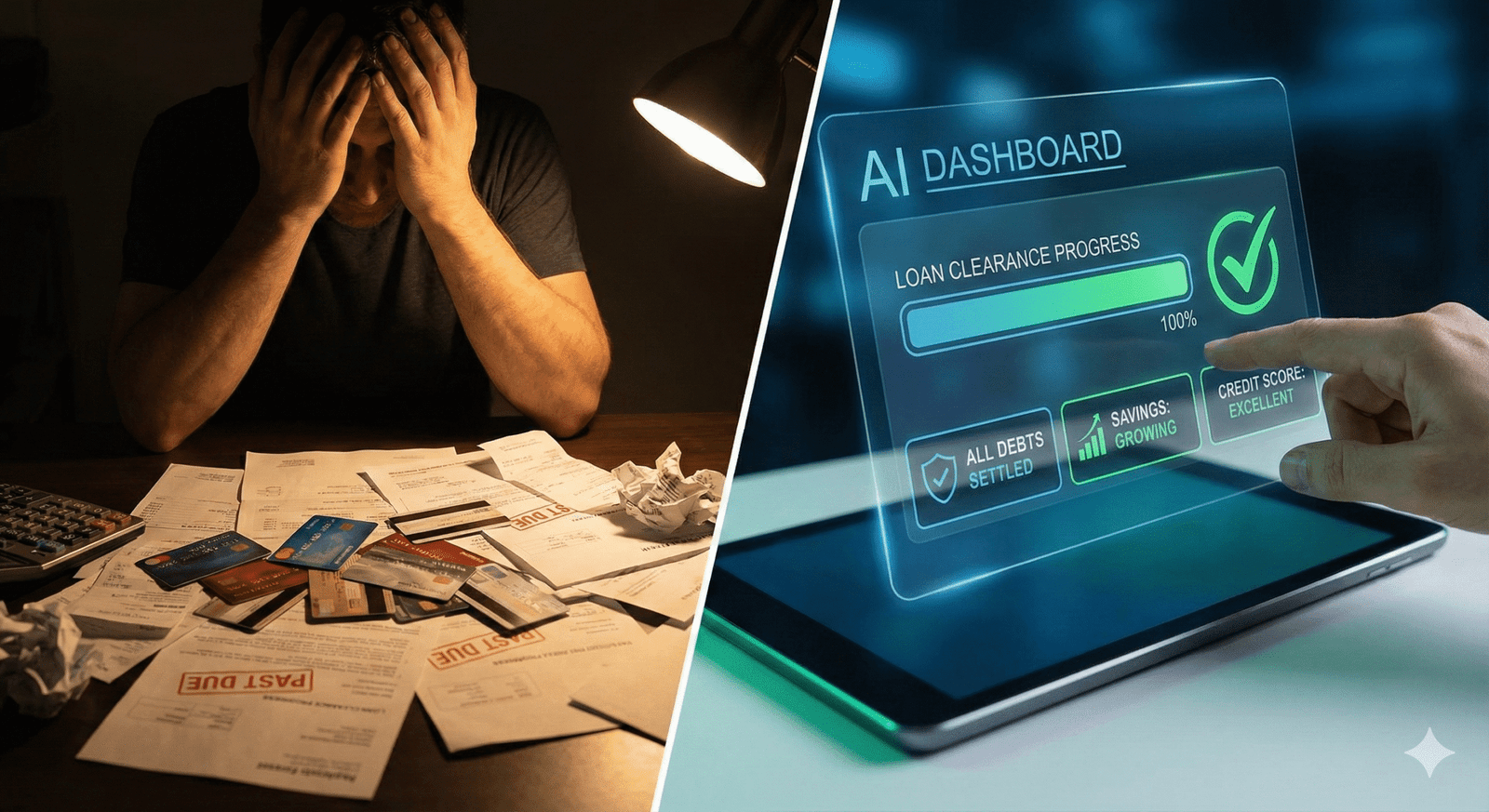

4Step 4: Use AI for Smarter Debt, Credit & BNPL Decisions

Debt can either be:

- A tool (education loan, business, productive asset), or

- A trap (unpaid BNPL, high-interest credit card, impulsive EMI shopping).

What AI Can Do Here

Modern finance apps and credit platforms use AI to:

- Warn you if your EMI-to-income ratio is too high.

- Show your projected interest cost if you only pay minimum due.

- Suggest faster repayment strategies (like debt snowball or avalanche).

You can also use AI chatbots (within bank apps or finance sites) to:

- Simulate “What if I pay ₹3,000 extra per month on this loan?”

- Ask for simplified explanations of terms (“What is APR?” “What is a credit utilization ratio?”).

Practical Rules to Stay Safe

- Keep total EMIs below 30–40% of your take-home income.

- Pay credit card dues in full – don’t get trapped in revolving credit.

- Treat BNPL like a loan, not “free money”.

AI will give you real-time numbers. You still make the decision.

5Step 5: “Trust But Verify” – Don’t Outsource Your Brain to AI

A big 2025 trend in investing is the rise of the “trust but verify” investor – people who use AI tools but always double-check important decisions.

Here’s how you can do the same:

Use AI As a Co-Pilot, Not a Driver

Good uses of AI:

- Summarizing complex financial reports in simple language.

- Comparing two investment options side-by-side.

- Explaining pros/cons of mutual funds vs FDs vs ETFs for your scenario.

Bad uses of AI:

- Asking “Which stock will double in 1 month?”

- Following any “guaranteed returns” advice.

- Investing based purely on a single AI reply without cross-checking.

Always Cross-Check With:

- The official website of the platform, fund house, or broker.

- SEBI/RBI circulars or investor education pages.

- A SEBI-registered investment advisor (RIA) for personalized advice.

Rule:

Let AI reduce confusion and save time — not replace learning.

7-Day Action Plan: From Confused to In-Control

Here’s a concrete mini-plan you can follow right after reading this:

Day 1 – Reality Check

- Install an AI-powered budgeting app.

- Connect at least your main spending account.

Day 2 – Money Map

- Let the app auto-categorize.

- See top 3 spending categories in the last month.

Day 3 – Set Limits & Goals

- Put soft monthly limits on eating out, shopping, and subscriptions.

- Create two goals: Emergency Fund and Investing SIP.

Day 4 – Automate Savings

- Set an auto-transfer (even ₹1,000) into a savings/low-risk fund.

Day 5 – Start a ₹500 SIP

- Open an account with a regulated broker/robo-advisor.

- Start a SIP in a basic index fund or conservative AI portfolio.

Day 6 – Clean Up Debt

- List all loans/BNPL/credit cards.

- Ask an AI tool (or chatbot) to help you prioritize which to repay first.

Day 7 – Review & Reflect (20 minutes)

- Check your app dashboard.

- Note 1 habit to reduce (e.g., food delivery thrice a week → twice).

- Increase SIP by a small amount if comfortable.

Repeat this cycle every month. You’ll be shocked how much clarity you gain in 90 days.

FAQs: AI, Money & Investing with ₹500

1. Is AI safe to use for personal finance in India?

AI tools are generally safe if you use regulated, trusted platforms and enable only secure, read-only access to your bank or UPI data. They can help with budgeting, planning, and portfolio suggestions but they cannot remove market risk or guarantee returns. Always double-check major decisions and avoid unregulated apps promising unbelievable profits.

2. Can I really start investing with just ₹500?

Yes. Many Indian platforms allow minimum investments of ₹100–₹500 in mutual funds, index funds, or digital gold. The key is not the amount, but the habit of investing regularly, ideally through SIPs. Over time AI tools can help optimize your portfolio once you have some capital built up.

3. What is the best AI tool for budgeting and investing?

There is no “one best” tool for everyone. The right app depends on whether you’re focused on budgeting, debt or investing, your preferred interface (mobile-only vs web + mobile), and fees, security, and features (alerts, auto-saving, robo-advice). A good approach is: start with a simple AI budgeting app, then add a SEBI-regulated investing platform for SIPs and long-term goals.

4. Will AI replace human financial advisors?

Unlikely. Current research shows that AI is enhancing, not replacing, advisors by giving them better data and analytics. Many affluent and tech-savvy investors use both: AI for speed and insights, and humans for context, emotions, taxes, and complex planning.

5. What if an AI app gives me bad advice?

Do not treat AI outputs as orders. Cross-check with at least one more reliable source. If in doubt, do nothing until you understand the decision. For large amounts, talk to a SEBI-registered advisor for personalized guidance.

How BytBloom Can Turn This Into Revenue (Without Breaking Trust)

Here’s how this kind of content can directly support your monetization:

Affiliate Marketing

- Link to trusted AI budgeting apps, investing platforms and finance tools with affiliate partnerships.

- Add comparison tables like “Best AI Budgeting Apps for Indians in 2025.”

Lead Magnets & Email List

- Offer free PDFs like:

- “7-Day AI Money Reset for Gen Z”

- “₹500 to First ₹1 Lakh: AI-Backed Investment Roadmap”

- Collect emails for newsletters, future products and surveys.

Info Products

- Launch low-ticket e-books or mini-courses:

- “AI + Money: A Beginner’s Playbook for Indian Students”

- “From UPI Chaos to Calm: Master Your Money with AI”

Ad Revenue

- This type of evergreen + trendy topic (“AI personal finance 2025”) attracts:

- High-intent traffic

- Good session duration

- Strong RPM potential via display ads & sponsorships

If you’re serious about taking control of your money in 2025:

- Start with one AI budgeting app today.

- Set up one emergency fund auto-transfer.

- Begin one ₹500 SIP this week.

Want step-by-step breakdowns, real tool reviews, and ready-to-use templates?

👉 Subscribe to BytBloom’s “AI Money Weekly” and get your free 7-Day AI Money Reset Checklist.