Why is it that some people seem to attract wealth and opportunities with ease, while others struggle paycheck to paycheck? Is it intelligence, luck, or privilege? While those factors matter, the true foundation of wealth lies in something much deeper: mindset.

The way you think about money, success, risk, and opportunity shapes your financial reality. A poor mindset limits your potential, while a wealthy mindset opens doors to growth, financial freedom, and long-term success.

This article will guide you through the five pillars of the wealthy mindset, showing you how to adopt the same mental frameworks that self-made millionaires and billionaires use to create lasting wealth. Whether you’re an entrepreneur, professional, or student, these principles can change your financial future.

Table of Contents

Toggle1. Wealth Begins in the Mind: Abundance Over Scarcity

The first and most important shift is understanding that wealth is a mindset, not just money.

A scarcity mindset says: “Money is limited. If someone else wins, I lose.”

A wealthy mindset says: “Opportunities are infinite. The more value I create, the more wealth I attract.”

Wealthy people see money as a tool, not the end goal. They focus on growth, creation, and long-term impact.

For example, Warren Buffett wasn’t born into wealth, but he developed a mindset of abundance early on. He saw every dollar not as money to spend but as a seed that could grow into a forest of wealth through smart investments.

Actionable Step:

Start reframing your thoughts about money. Instead of saying, “I can’t afford this,” ask, “How can I afford this in the future?”. This subtle shift opens your brain to opportunities and solutions instead of shutting them down.

2. Long-Term Vision and Delayed Gratification

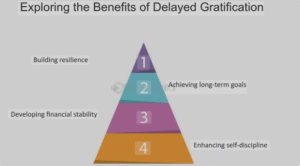

The wealthy mindset is rooted in thinking long-term. Average people often focus on short-term pleasures—new gadgets, luxury dinners, or flashy purchases. Wealthy people delay gratification, sacrificing short-term comfort for long-term freedom.

Instead of buying liabilities, they invest in assets.

Instead of asking, “What feels good now?” they ask, “What will create wealth 10 years from now?”

Instead of thinking about income, they focus on wealth-building systems.

Take Jeff Bezos as an example. When he started Amazon, the company wasn’t profitable for years. Instead of chasing short-term gains, he reinvested earnings into growth. That long-term mindset turned Amazon into one of the most valuable companies in history.

Actionable Step:

Before making financial decisions, ask yourself: Will this purchase make my life better today, or will this investment make my life better tomorrow? Start practicing delayed gratification in small ways—it compounds massively over time.

3. Resilience: Embracing Risks and Learning from Failure

Another defining feature of the wealthy mindset is how the wealthy approach risk and failure.

For any, failure is the end of the road. But for wealthy thinkers, failure is a stepping stone to success. They treat mistakes as lessons, not losses.

Elon Musk risked nearly everything funding Tesla and SpaceX. Despite setbacks, his resilience and bold risk-taking built multi-billion-dollar companies.

Oprah Winfrey faced early rejection in television, but her persistence and mindset transformed her into one of the wealthiest and most influential women in the world.

The wealthy don’t fear risk—they fear stagnation. They understand that calculated risks, even when they fail, bring invaluable experience that pays off later.

Actionable Step:

Reframe your failures. Instead of asking, “Why me?” ask, “What can I learn from this?”. Every setback carries feedback that can guide you to a better path.

4. Multiple Streams of Income: Making Money Work for You

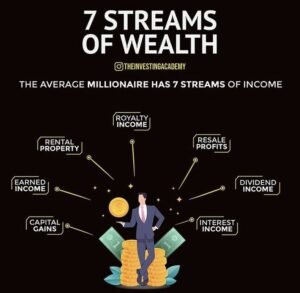

Most people depend on a paycheck. But wealthy thinkers know that financial security comes from multiple streams of income. These can include:

Investments (stocks, bonds, real estate)

Businesses or side hustles

Digital assets (royalties, online content, intellectual property)

Passive income (dividends, rental income, licensing)

The wealthy mindset doesn’t ask, “How can I work harder for money?” Instead, it asks, “How can my money work harder for me?”

This principle is why many wealthy individuals invest aggressively. Instead of letting money sit idle, they deploy it into opportunities that multiply.

Actionable Step:

If you’re just starting, build one additional stream of income. It could be freelancing, investing in index funds, or starting a small online business. Over time, add more streams. Eventually, these will free you from depending on a single paycheck.

5. Creating Value: The True Secret to Wealth

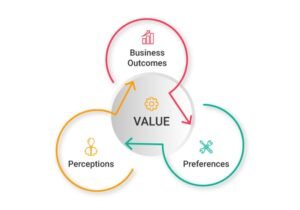

Here’s the ultimate truth: Wealth is a by-product of value creation.

The richest people in the world didn’t just chase money—they solved problems on a massive scale.

Steve Jobs didn’t just sell phones—he revolutionized communication.

Elon Musk didn’t just build cars—he reimagined transportation and energy.

Bill Gates didn’t just sell software—he gave the world tools to transform productivity.

The wealthy mindset focuses on impact first, money second. When you create genuine value that improves lives, money naturally follows.

Actionable Step:

Shift your focus from asking, “How do I make money?” to “What problem can I solve that helps others?”. If your work consistently creates value, wealth will follow as a natural outcome.

Conclusion

Developing a wealthy mindset is the first step toward financial success and freedom. It’s not about how much money you have today—it’s about how you think and act every day.

To recap, the five pillars of the wealthy mindset are:

Abundance Over Scarcity – Think in terms of opportunities, not limitations.

Long-Term Vision – Delay gratification and focus on future growth.

Resilience – Embrace risks and learn from failure.

Multiple Streams of Income – Make money work for you instead of relying on one source.

Value Creation – Solve problems, help others, and wealth will follow.

By adopting these principles, you’ll not only improve your relationship with money but also with success, opportunities, and life itself.

Remember this: Wealth begins in the mind before it appears in the bank. Change your mindset, and your financial reality will eventually reflect that change.